Filing income tax may seem overwhelming, but if you had the right knowledge, you can take full advantage of the available tax reliefs to lower your taxable income. The Malaysian government has introduced several tax relief for the previous year, helping individuals and families to reduce their financial burdens.

From lifestyle expenses to education fees to medical costs and electric vehicles, these tax relief cover a wide range of categories. Understanding what you can claim ensures that you’re not paying more tax than necessary. Whether you’re an employee who earns, a business owner, or a student’s guardian, these are various ways to maximize savings. Here’s a breakdown of the key tax reliefs you should know about when filing your taxes this year.

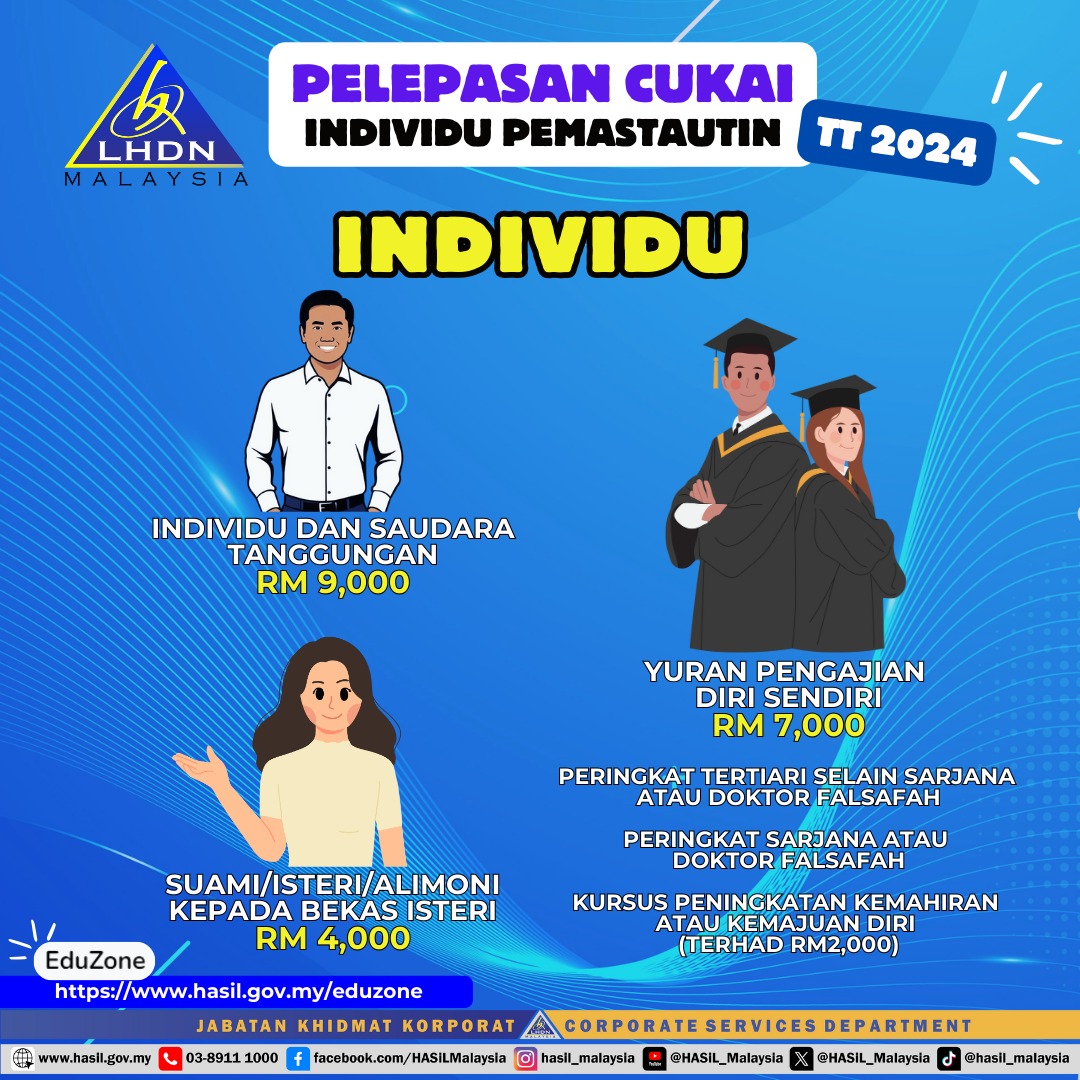

1) Individual and Dependent Relatives Relief

This relief is automatically granted to all the ones who pay the tax. Additionally, individuals with disabilities registered with the Social Welfare Department (JKM) are entitled to an extra RM6,000 relief.

2) Self-Education Fees

Self Education fees can go up to RM7,000. Tax relief is available for individuals pursuing higher education. For example,

PostGraduate (Masters or Doctorate), any course of education, Undergraduate (Courses in law, accounting, Islamic financing, technical, vocational, industrial, technology or scientific fields) and if you are recognized by the Department of Skills Development for Upskilling course, there will be a relief of RM2,000.

3) Lifestyle Purchases for Own, Spouse, or Child

Lifestyle purchases go up to RM2,500. The Relief covers expenses such as, purchase or subscription of books, journals, newspapers, magazines, etc. Purchase of personal computers, smartphones or tablets (not for business). Payment of monthly internet subscription bills (under your name) , fees for skill improvement or personal development class.

4) Spouse Relief

Spouse reliefs can go up to RM4,000. Applicable if your spouse has no source of income and prefers joint assessment under your name. An additional RM5,000 relief is available if your spouse is disabled. The relief extends to divorced individuals paying for their former spouses.

5) Electric Vehicle (EV) Charging Equipment

This can go up to RM2,500. Tax relief is available for expenses related to the purchase, installation or rental of EV charging equipment. This includes subscriptions for the use of EV charging facilities.

6) Medical Expenses

The individual income tax exemption for medical expenses has been increased to RM10,000. This covers payments that are made under medical or health insurance or takaful products with a co-payment feature.

7) Sports Related Lifestyle Relief

In addition to the general lifestyle relief, you can claim for sports related expenses up to RM 1000 including, Purchase of sports equipment for activities defined under Sports Development Act 1997, Payment of rental or entrance fees to sports facilities, Registration fees for sports competitions approved by the Commissioner of Sports and Gymnasium membership fees or sports training costs.

8) For Children (18+) in Full Time Education, an additional relief is given.

You can claim tax relief of RM2,000 for each unmarried child aged 18 and above who is enrolled in full time education, such as certificates, matriculation, A-Levels or Foundation courses. An additional relief up to RM8,000 per child is given for those pursuing further education.

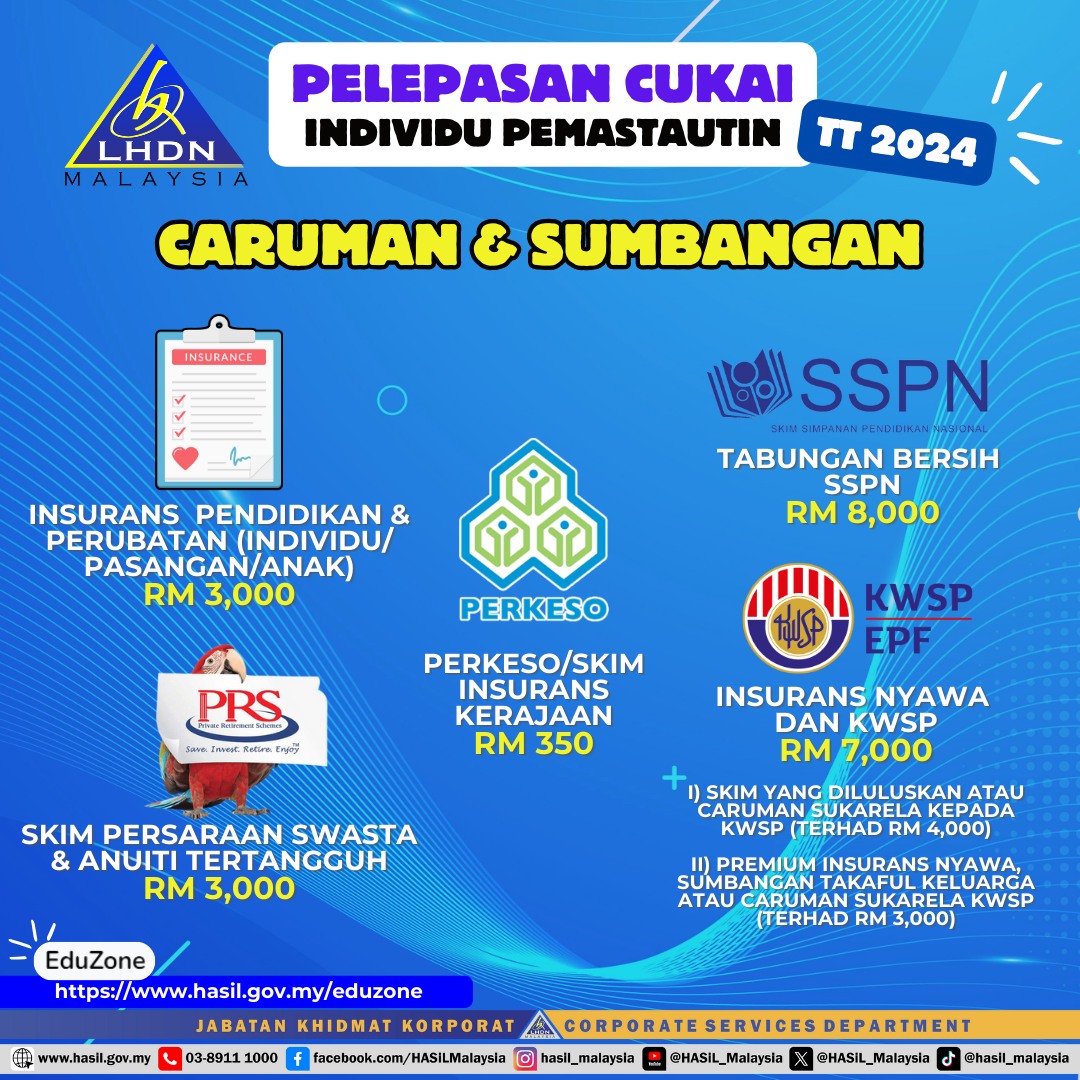

9) Insurance Premiums

Tax reliefs on education insurance premium payments and medical insurance has been increased to RM4,000. Offering more savings for taxpayers investing in health and education security.

10) National Education Savings Scheme

Deposits made into Simpan SSPN accounts are eligible for tax relief up to RM8,000 for the 2024 assessment year. Private retirement schemes up to RM3,000, Social Security Organisation (SOCSO) up to RM 350. Employees Provident Fund (EPF) up to RM 4000 and life insurance up to RM3000.

To know more information on this, check LHDN website on the entire tax relief list.

By utilizing the available text reliefs, you can significantly lower your taxable income and increase your savings. Whether it’s for personal use, family needs or investments, these deductions are made to ease your financial strain. Before filing your taxes, ensure you have proper documents such as receipts or statements, to support your claims. The deadline for your tax is on 30th April 2025, so make sure to always have an eye and constantly check the Lembaga Hasil Dalam Negeri (LHDN) for latest updates and login to MyTax to file your income tax returns.

Sources: SAYS

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.