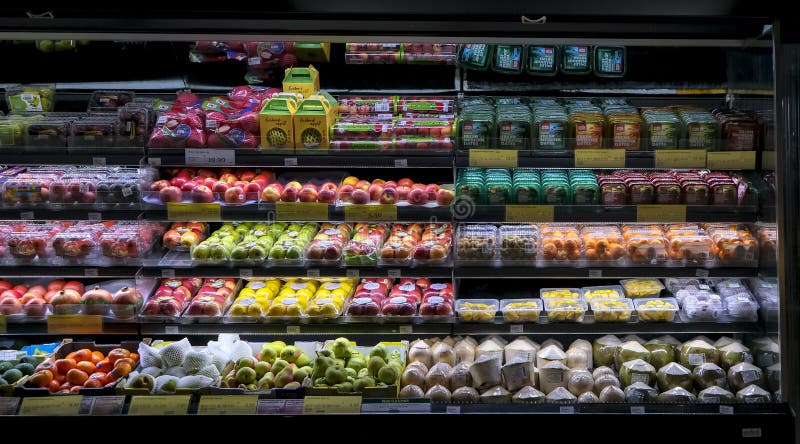

The government is reviewing its decision to impose the revised Sales and Services Tax (SST) on imported fruits such as apples and mandarin oranges, Deputy Prime Minister Datuk Seri Ahmad Zahid Hamidi said today, in light of concerns about its impact on lower-income consumers.

Speaking at the Kemas Teachers Day Celebration, he acknowledged that the fruits in question are not produced locally and are fully imported, making them everyday necessities for many Malaysians rather than luxury items.

“I believe it is reasonable for the new SST rate on certain goods to be reviewed. There may be an adjustment for certain materials to be categorized for tax at five to ten percent. But don’t take it conclusively”, Datuk Zahid added, indicating that the final decisions will be made after further discussion within the cabinet.

His statement comes in response to concern raised by Mydin Holdings, Managing director, who described the move as unreasonable, raising that it would disproportionately affect low-income consumers.

Datuk Zahid has also said that the points are valid and should be brought to the cabinet, noting that the issue touches on public access to affordable food.

“The revenue from fruit tax to the country is not that high. So if SST is imposed, the price will increase. I understand the intention behind the tax may be to protect local fruits, but we do not produce apples or mandarin oranges in Malaysia. I’m confident the Ministry of Finance and the Ministry of Economy are also looking into this”.

The government’s revised SST policy was announced on 9th June 2025, and is set to take effect on 1st July 2025. While the sales tax rate will remain unchanged for essential goods, a 5% or 10% rate will be applied to non-essential items including selected imported goods.

Additionally, the scope of the service tax will be expanded to six new sectors, including rental or leasing, construction, finance, private healthcare, education and beauty. As mentioned in our previous article, this is the service tax that is expanded.

As public concern grows over the affordability of everyday goods, Datuk Zahid’s remarks signal the possibility of a more targeted approach to the tax framework to prevent undue financial pressure on low-wage earners.

Sources: MalayMail

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.