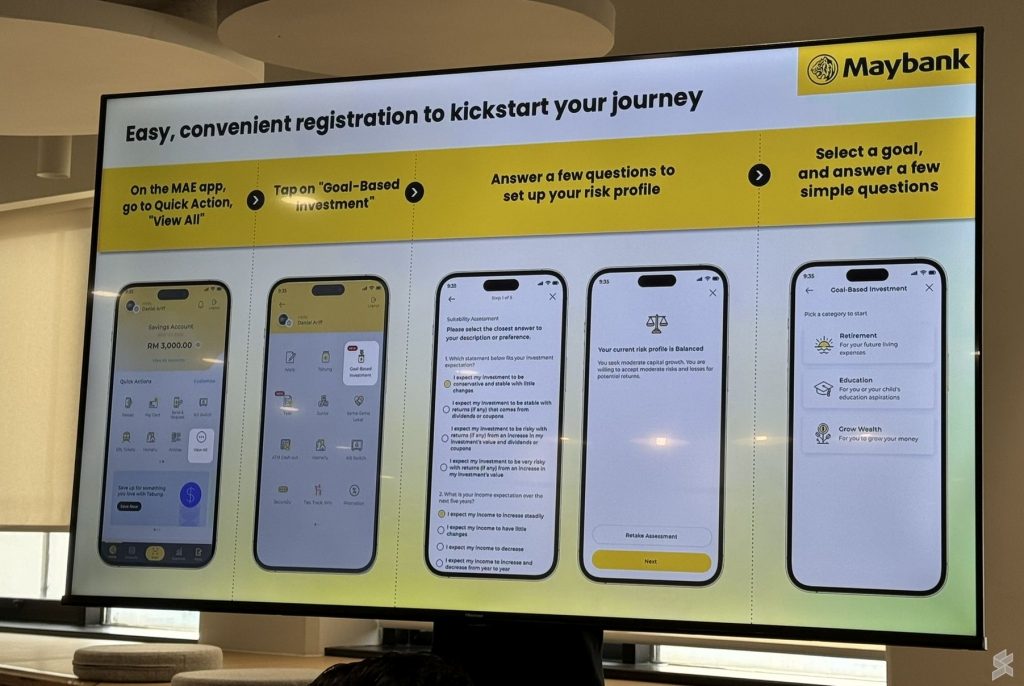

Maybank Malaysia has introduced a new digital investment platform, Goal-Based Investment, that is aimed at beginners and first-time investors.Users can begin investing with RM200 thanks to this service, which is accessible through the MAE App and Maybank2u Web. New users can open a Maybank savings or current account online in less than 10 minutes, while existing customers can get started right away.

The platform provides a range of investment funds that are professionally managed and catered to different financial objectives like retirement, saving for education, or building wealth.

Group CEO of Community Financial Services at Maybank, Syed Ahmad Taufik Albar, emphasized that the new tool intends to remove frequent obstacles such excessive fees and financial complexity in order to make investing easier.

In addition to traditional investment alternatives, the website offers Shariah-compliant funds, with promotional offers such as 0% sales charges on initial purchases until June 25, 2024.Maybank Goal-Based Investment seeks to reduce these barriers by making investing accessible and inexpensive to everyone, requiring just a little investment, and offering a guided experience via digital banking systems.

Maybank thinks that GBI’s modest entrance threshold of RM200 will encourage more people to try their hand at investing.With the help of the Goal-Based-Investment (GBI) function, young people may make more informed financial decisions, regardless of whether they begin with aggressive or conservative investing.

With its straightforward registration process and lack of branch visits, users may monitor their assets straight from their digital devices.

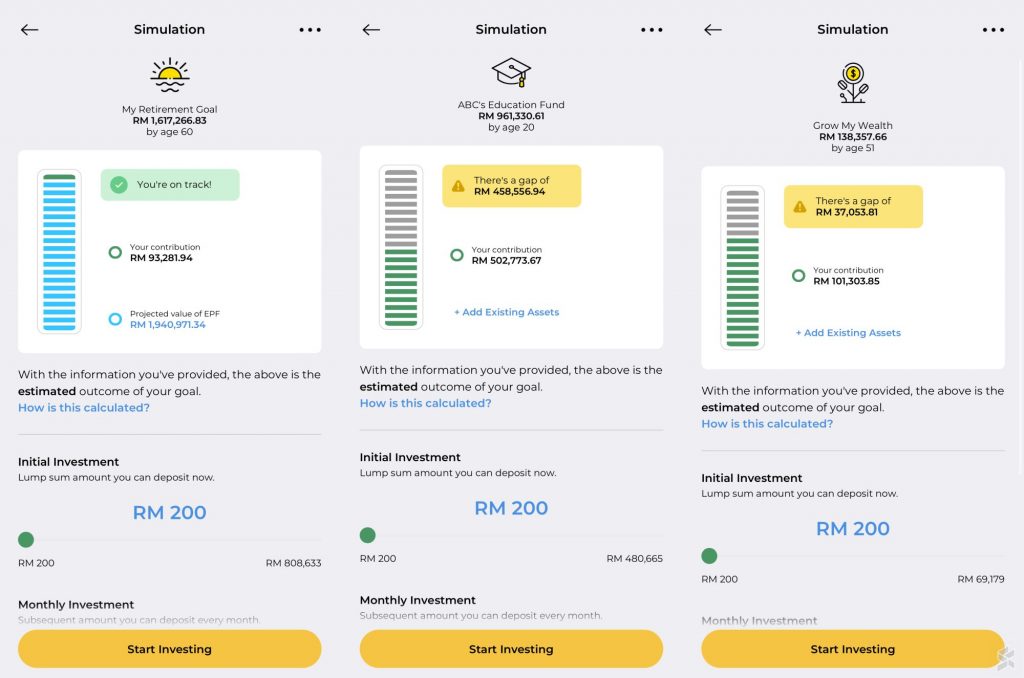

Customers can choose their unit trust funds manually or through an automated curation that is tailored to their specific risk assessment, aim, and timetable. GBI will automatically produce a simulation that accounts for inflation when a new investment objective is specified, and it will pose straightforward questions depending on the projected outcome.

The simulation would also allow users to add additional sources of savings or investments to totalize their money in order to attain their aim. For instance, you can include your current EPF savings when choosing your retirement goal, and GBI will factor in the protected value when you retire.

You have the option to choose the course type and the intended country when you set educational goals. As predicted, the set goal was to study in the UK rather than Malaysia or Singapore. On the GBI page of Maybank, you can test out the simulator. While the minimal monthly contribution is RM200, there are no penalties for missing your monthly investment target.

The design is simple, and you can quickly see if you’re on track or lagging behind your investing goal. A one-time lump sum top up can help you catch up if you’re falling short of your target. It will take two to three business days for the money to be withdrawn to your primary account, although users can halt the GBI and modify their investing objectives at any moment.

MAE offers an instantaneous withdrawal option that is linked to a savings account for users who need a short-term solution with greater flexibility. In addition, Maybank Singapore users can use the GBI feature through the Maybank2u site and SG (Lite) app.

You can visit Maybank2u’s link for additional information.

Source : FINTECH

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.