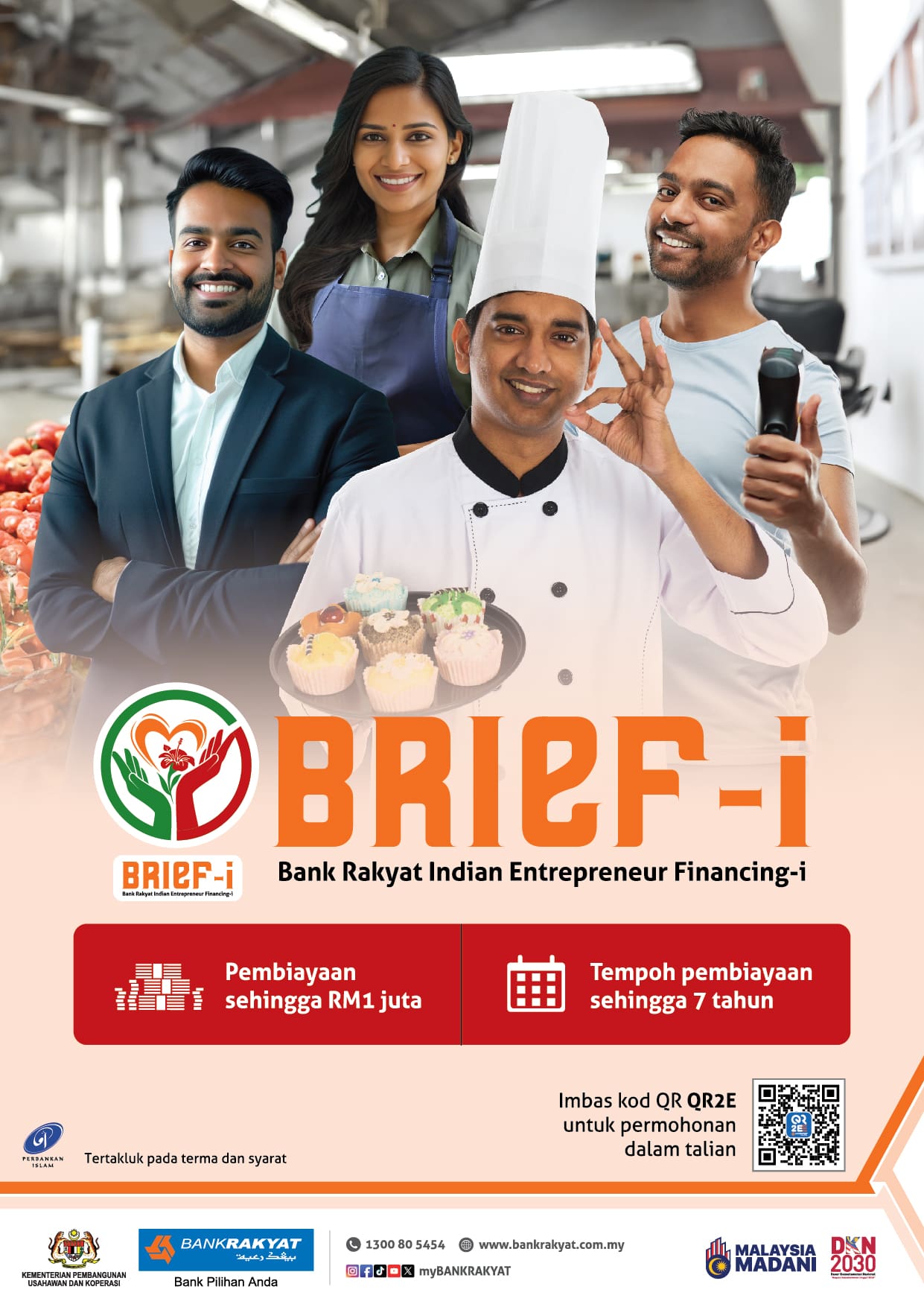

BANK Rakyat has allocated RM50 million through the Bank Rakyat Indian Entrepreneur Financing-i (BRIEF-i) programme to support Indian entrepreneurs running micro, small, and medium enterprises (MSMEs). This substantial funding aims to assist these business owners in addressing their working capital requirements and capital expenditure needs, thereby facilitating business expansion and growth.

Entrepreneur Development and Cooperatives Deputy Minister Datuk Ramanan Ramakrishnan stated that BRIEF-i exemplifies Bank Rakyat’s commitment to inclusivity and its longstanding dedication to holistic and comprehensive socioeconomic development for Malaysian communities, a commitment that has been steadfast since the bank’s founding 70 years ago.

“BRIEF-i is an initiative that can create a brighter future for the Indian entrepreneur community. I believe that by supporting the Indian entrepreneur community, we can nurture a more diversified, resilient and prosperous economy for all,” he said at the launch of BRIEF-i here today.

Ramanan emphasized that BRIEF-i stands out among financing programs with its distinctive benefits. For micro enterprises, it offers a highly competitive flat rate of 6.50% per annum, providing financing amounts between RM1,000 and RM50,000, thus making it an accessible and cost-effective option for smaller businesses in need of financial assistance. For small and medium enterprises (SMEs), the program provides a financing rate of the base financing rate (BFR) plus 0.67% per annum, along with a guarantee fee, supporting financing amounts ranging from RM50,001 to RM1 million. This broad range of financing caters to diverse business needs, enabling substantial business growth and expansion, and illustrating BRIEF-i’s commitment to fostering economic development across various business sizes.

BRIEF-i differentiates itself from other financing programs by not requiring entrepreneurs to maintain forced savings or join self-help groups. This flexibility allows entrepreneurs to concentrate entirely on their business operations without extra obligations. Additionally, BRIEF-i boasts a streamlined documentation process, making the application both simple and efficient compared to other financing options. For SME clients, the program includes a guarantee from Syarikat Jaminan Pembiayaan Perniagaan (SJPP), while micro enterprises benefit from free takaful protection. These features collectively underscore BRIEF-i’s commitment to supporting entrepreneurs with minimal hassle and comprehensive security. The approval process will be completed within just 14 business days.

“To be eligible, micro-enterprises need to demonstrate a minimum operational history of one year, along with favorable CTOS and Central Credit Reference Information System (CCRIS) records. SME entrepreneurs, on the other hand, are required to have operated for at least two years, maintain satisfactory CTOS and CCRIS records, and exhibit a positive net asset value,” stated Ramanan.

Meanwhile, according to Bank Rakyat Chairman Datuk Mohd Irwan Mohd Mubarak, the BRIEF-i initiative is geared towards fostering nationwide economic advancement with a focus on inclusivity. This aligns closely with the objectives outlined by Bank Negara Malaysia, aiming to deliver sustainable and inclusive financial solutions that cater to the diverse needs of all customers, particularly those who have been historically underserved or overlooked.

For further information, please visit a nearby Bank Rakyat branch or contact the Bank Rakyat Call Center at 1-300-80-5454.

Source: Focus Malaysia

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.