SME Bank Malaysia Berhad has introduced the Vanigham Financing Scheme (VFS), a new financial initiative aimed at supporting small businesses in Malaysia. With a total fund allocation of RM50 million, this scheme is designed to provide financial assistance and empower small enterprises to grow and thrive in the competitive market.

The launch of the VFS aligns with SME Bank’s broader strategy to promote financial inclusion, ensuring that all entrepreneurial groups have equal opportunities to grow their businesses. This financing scheme is designed to provide essential financial support for asset acquisition, commercial vehicles, and working capital, allowing entrepreneurs to expand their operations, strengthen their market presence, and enhance their competitiveness.

YB Dato’ Sri Ramanan Ramakrishnan, Deputy Minister of Entrepreneur Development and Cooperatives (“MECD”), highlighted the critical role of MSMEs in national economic growth. “Malaysia’s Gross Domestic Product (“GDP”) grew by 4.8% in Q4 2024, with MSMEs contributing RM613.1 billion in 2023. This year, they are projected to account for 45% of GDP and 25% of total exports. Government-linked entities must actively support this sector, particularly in financing, to drive expansion. SME Bank’s launch of the VFS is timely, aligning with the MADANI Government’s agenda to foster inclusivity, diversity, and a sustainable business ecosystem.”

“MECD has mobilised many initiatives to empower the MSME sector throughout the country and across all sectors through innovative financing offerings. These efforts, through various Government agencies such as Tekun Nasional, Bank Rakyat, SME bank, Pernas, SME Corp and the Malaysian Cooperative Commission have successfully channeled approximately RM9.577 billion to a total of over 300,000 entrepreneurs nationwide in total financing and grants. Therefore, the Ministry lauds SME Bank for their continuous efforts in providing access to new financing that is more inclusive and comprehensive to ensure that every segment of entrepreneurs can continue to thrive.”

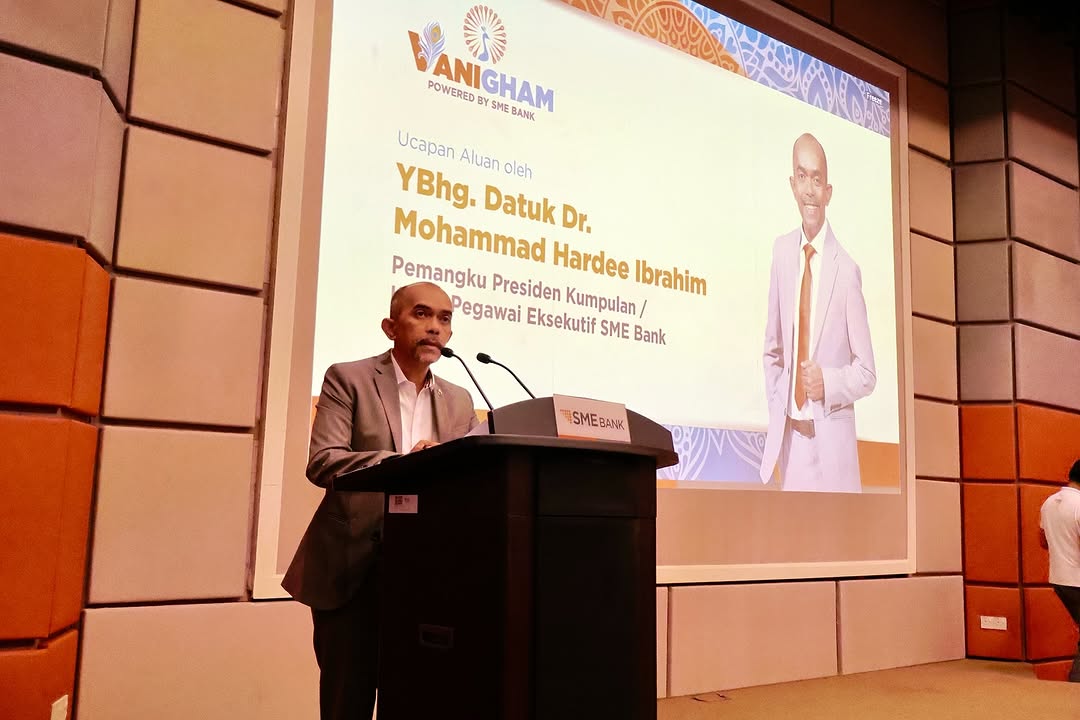

Datuk Dr. Mohammad Hardee Ibrahim, Acting Group President/Chief Executive Officer of SME Bank said, “Aligning with our developmental mandate, we are cognisant of the importance to ensure that all MSMEs are given adequate financing support that can help them elevate the growth of their business. As such, the rolling out of the VFS serves as a testament of our role in providing tailored financing to specific target groups – recognising small entrepreneurs as key contributors in complementing the overall SME ecosystem, whilst serving as one of the key pillars in driving Malaysia’s economy. Through the introduction of VFS, we hope to encourage more innovative business participation and stimulate strategic entrepreneurship across Malaysia.”

The VFS is a RM50 million financing initiative that provides funding from RM100,000 to RM300,000 for the purchase of machinery, commercial vehicles, and working capital. With a government-backed profit rate subsidy, this scheme aims to support business growth and expansion. Entrepreneurs can apply for the VFS until 31 December 2027, seizing a valuable opportunity to strengthen their enterprises.

The launch of VFS was officiated by YB Dato’ Sri Ramanan Ramakrishnan, Deputy Minister of Entrepreneur Development and Cooperatives (“MECD”) and Dato’ Sri Khairul Dzaimee bin Daud, Secretary General of the Ministry of Entrepreneur Development and Cooperatives (“MECD”) in attendance, along with Dato’ Muslim Hussain, Chairman of SME Bank and Datuk Dr. Mohammad Hardee Ibrahim, Acting Group President/Chief Executive Officer of SME Bank.

The VFS goes beyond direct financing by aligning with key government initiatives under the National Budget 2025. It is strategically integrated with SME Bank’s flagship programs, such as the Jaguh Serantau Programme and the HalalBiz Financing Programme, further enhancing support for small businesses.

Reinforcing SME Bank’s developmental role in empowering entrepreneurs, the Bank in the National Budget 2025 continued to be entrusted by the Government with over 1 Billion of existing and new programmes, focusing on financial inclusion to MSMEs across key strategic sectors such as the Bumiputera, Technology, Environmental, Social and Governance (“ESG), Halal and Tourism segments.

For further details on the VFS, along with other financing and beyond financing programmes by SME Bank, visit www.smebank.com.my, SME Bank’s Facebook page, or contact SME Bank’s Contact Centre at 603-26037700.

All the information and images are provided by SME Bank Group Strategic Communication.

Follow us on Instagram, Facebook or Telegram for more updates and breaking news.